Average middle-class Nevadan family to see $610 gain from tax reform

The just-passed tax reform bill lowers the tax rate for all income groups and is estimated to result in an average $610 annual savings for middle-income Nevada families, according to an analysis from the nonpartisan Tax Foundation.

One of the most powerful elements of the plan is the economic gains that will be achieved from its significant reduction in the corporate tax rate, with the Tax Foundation estimating that Nevada will see an additional 3,048 full-time jobs created as a result of the plan.

While the economic benefits of lowering the corporate tax rate come over time — businesses have more money to invest in capital, which increases productivity, creating more jobs and boosting wages — several major corporations have already announced plans to boost wages in response to the newly-passed legislation.

AT&T, for example, announced that they will give a $1,000 bonus to its more than 200,000 rank-and-file U.S. employees, in addition to boosting their U.S. capital spending by $1 billion.

Wells Fargo and Fifth Third Bancorp announced that they would be boosting the minimum wage for all employees to $15 an hour as a result of the tax plan’s passage — a reminder that the best mechanism for boosting wages is pro-growth policies, not laws outlawing employment below an arbitrary level.

One would think "progressives" would be cheering such positive outcomes, but the blinding effects of partisan rage have risen to truly unprecedented levels.

In uniformly denouncing the tax plan, Democrats have relied on three central themes.

First, while they are unable to deny that the plan lowers taxes for all income groups, they characterize it as being disproportionally favorable to the wealthy. This meme is based on the banal observation that because the wealthy pay vastly more taxes, a tax cut will benefit them more than people whom, on average, pay much less in taxes!

For instance, in their analysis of the plan, the Congressional Joint Committee on Taxation (JCT) noted that, in aggregate, households earning less than $40,000 do not pay any income taxes at all. Unsurprisingly, those who do not pay taxes cannot get much of a tax cut.

And when payroll and excise taxes are excluded, it is actually middle-income earners who see the largest gains as a share of their total tax burden, according to an analysis by Chris Edwards of the CATO Institute, drawing on data from the JCT.

Yes, the wealthy will benefit from this plan, a mathematical necessity of tax cuts benefiting those who pay the most taxes. However, if someone is going to object to a plan that indisputably boosts the earnings of middle-class Nevadans, just because the wealthy also benefit, perhaps it’s time they re-examine their priorities.

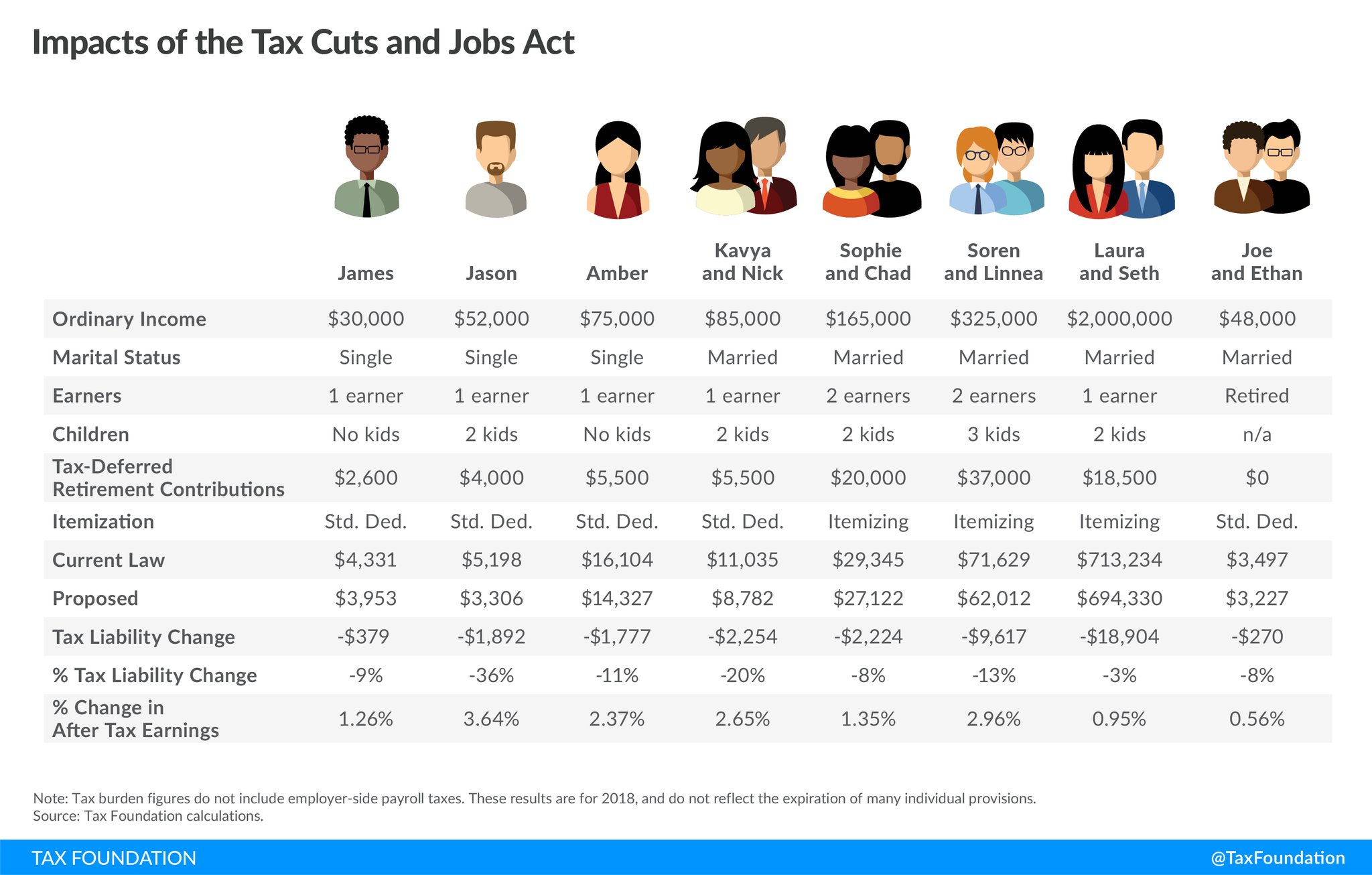

Everyone wins:

The second major objection against the GOP tax reform package is the fact that, due to Senate budget rules, the plan had to contain a provision causing some of the tax cuts to expire after 2025.

As a result, some opponents have portrayed the bill as a "tax hike" on middle class America, because at some point in the future the new, lower rates might not be extended.

It's a disingenuous argument that demonstrates just how partisan the debate has become. After all, Congress will meet again before 2025. Given that Republicans have already stated their intention to make the cuts permanent at that time, the only way middle-class America will see a tax increase after 2025 is if Democrats control Congress by then and vote not to extend the lower rates. While that is certainly a possibility, it seems like a rather weak argument against lowering taxes on the middle-class in the meantime!

The Washington Post released a helpful calculator that allows you to estimate how the plan will affect you. A single Nevadan earning $45,000 that takes the standard deduction will save an estimated $909. A married household with 2 kids and combined earnings of $65,000 will save an estimated $1,825. You can enter in your information to see how the plan will affect you by clicking here — you are likely to find yourself pleasantly surprised at how much more of your own money you get to keep moving forward.